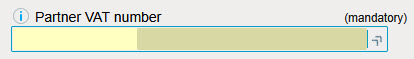

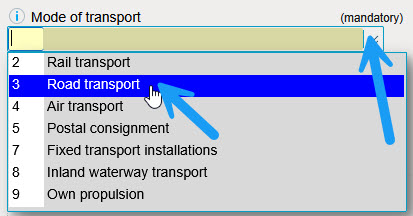

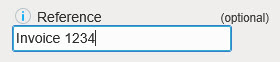

Partner VAT number : The PSI indicates the VAT identification number of the intra-Community acquirer of the goods in this box. It is the same identification number than indicated in the recapitulative statements of intra-Community supplies sent to "Administration de l'Enregistrement et des Domaines”.

IDEPWEB displays this box only for dispatches and even checks the validity of the identification number (for most Member States).

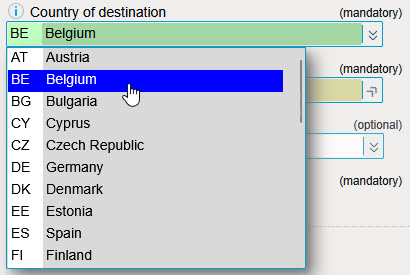

For dispatches, the country of destination is the Member State to which the PSI ships the goods. The country of consignment/destination is expressed by a two-digit alphabetical code and must be a member state of the European Union

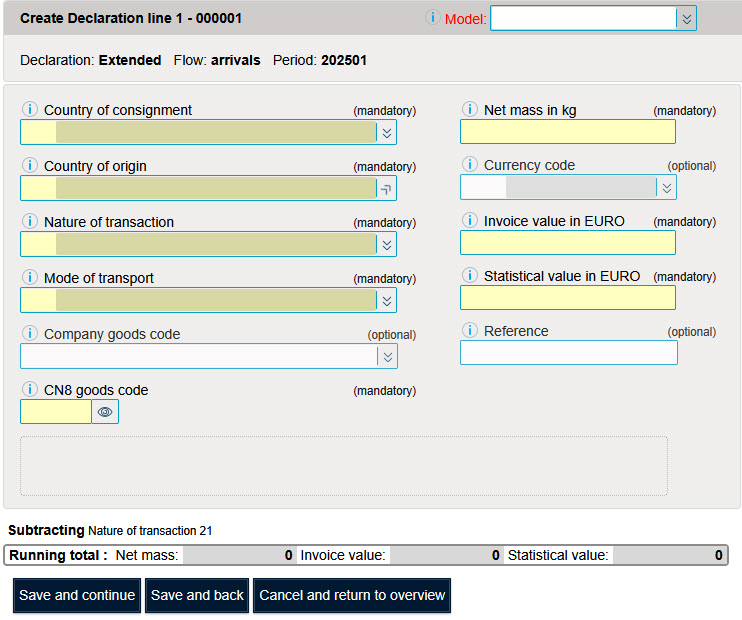

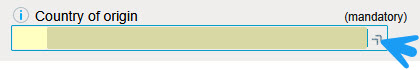

Country of origin means the country where the goods originally came from, i.e. the country of production or assembling. In the case of goods produced in several countries, the last country of substantial transformation is the country of origin. It is a two-digit alphabetical code taken from the following countries list.

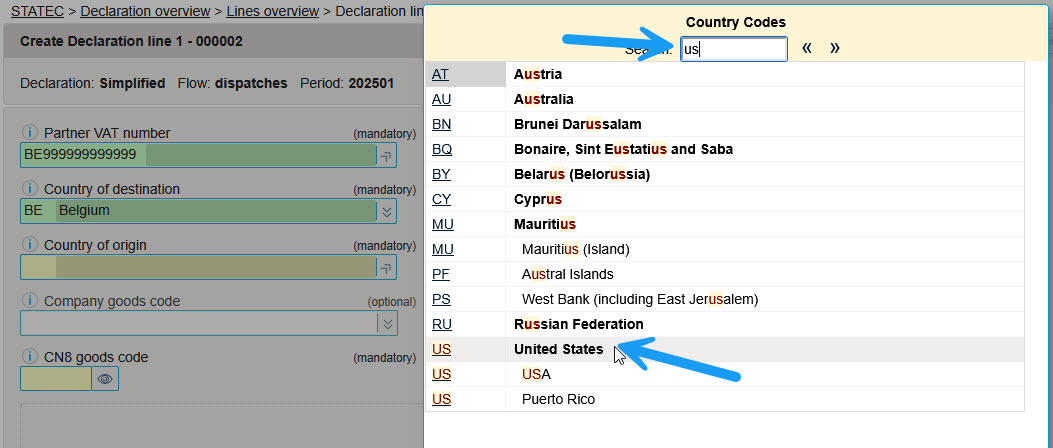

The Nature of Transaction refers to all the characteristics (purchase/sale, contract work, etc.) that are useful to separate one transaction from another. The Nature of transaction is specified by a two-digit code taken from the list below.

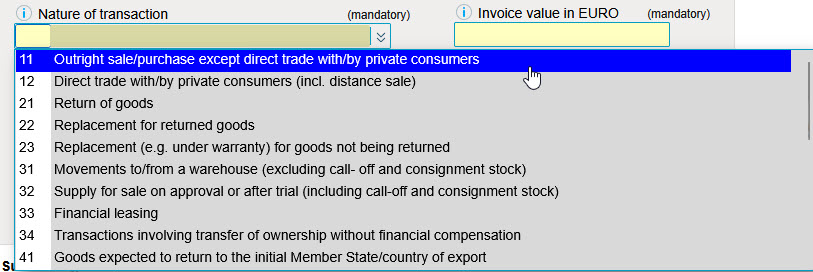

For arrivals and dispatches, the mode of transport corresponds to the means of transport by which the goods are expected to cross the border of Luxemburg.

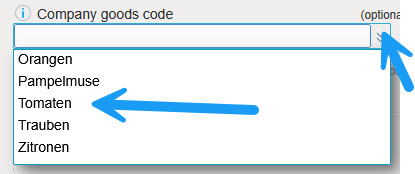

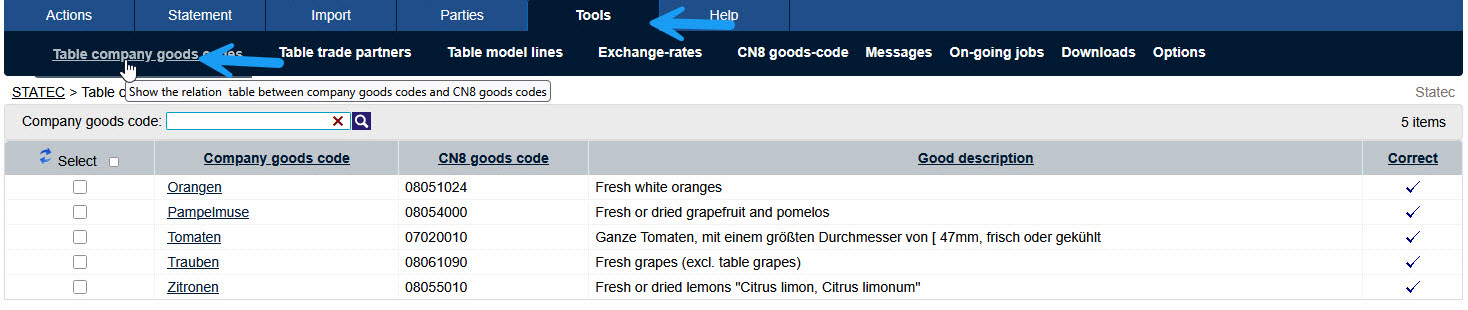

Optional indication of an internal commodity code label used in the company.

The company code table is accessible via the "Tools" menu option "Table company goods codes".

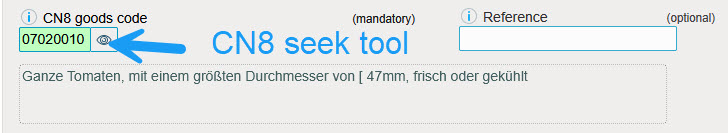

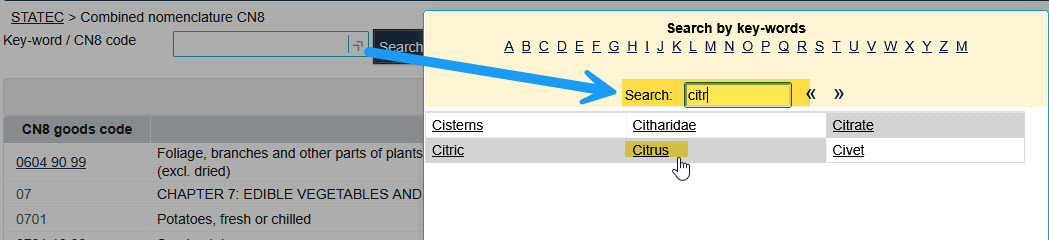

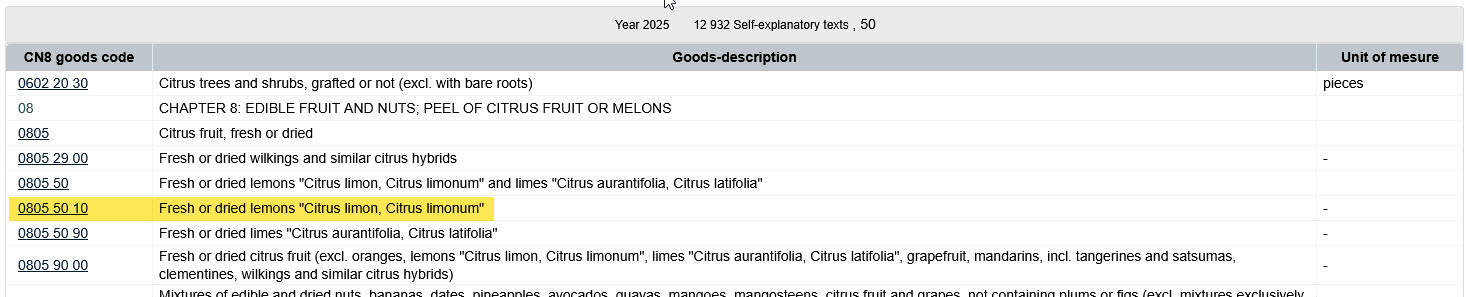

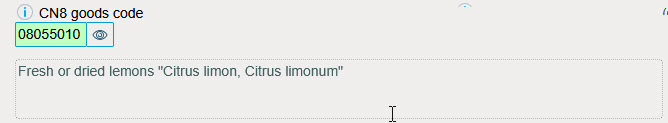

Intrastat data must be provided by type of goods, i.e. for each good, you have to indicate a code corresponding to eight digits taken from the Combined Nomenclature (CN8 code). The Combined Nomenclature can be downloaded free of charge from internet site 3.1 Commodity classification.

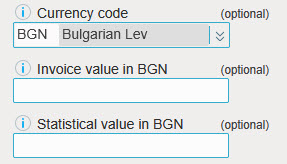

Currency code. This field can be used for the conversion of a foreign currency into Euro..

Amount invoiced excluding VAT in foreign currency. The conversion to Euro is done automatically based on current exchange rates.

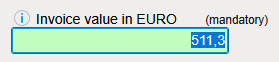

The invoice value is the amount before tax shown on the invoice or any other document. This amount should be shown as a positive number and per commodity code.

When the invoiced price of an item combines the value of the goods and the services provided, the services should be deducted from the price, because only the value of the goods should be reported.

However, in the particular case of processing or repair, the respective amount of processing/repair is exceptionally taken into account in the Intrastat system.

The statistical value is the value calculated at the Luxembourg national border. A distinction should be made between dispatches and arrivals. The statistical value is an amount without tax and shown as a positive number.

Dispatches from Luxembourg to a Member State: Theoretically, the statistical value is composed of the value of the goods plus additional charges (freight, insurance) relating to the part of the journey located on Luxembourg territory. This is the F.O.B. value (free on board). Due to the size of Luxembourg’s territory, the transport and insurance costs in question are insignificant. For the sake of convenience, STATEC does not require them to be taken into account. In the case of a factory-outgoing invoice, the statistical value is identical to the invoiced amount. In case of a free to destination invoice, you should reduce the invoiced value by the total amount of transportation and insurance costs to get the statistical value.

The indication of the reference is optional. The field is destined to indicate an invoice number e.g. .

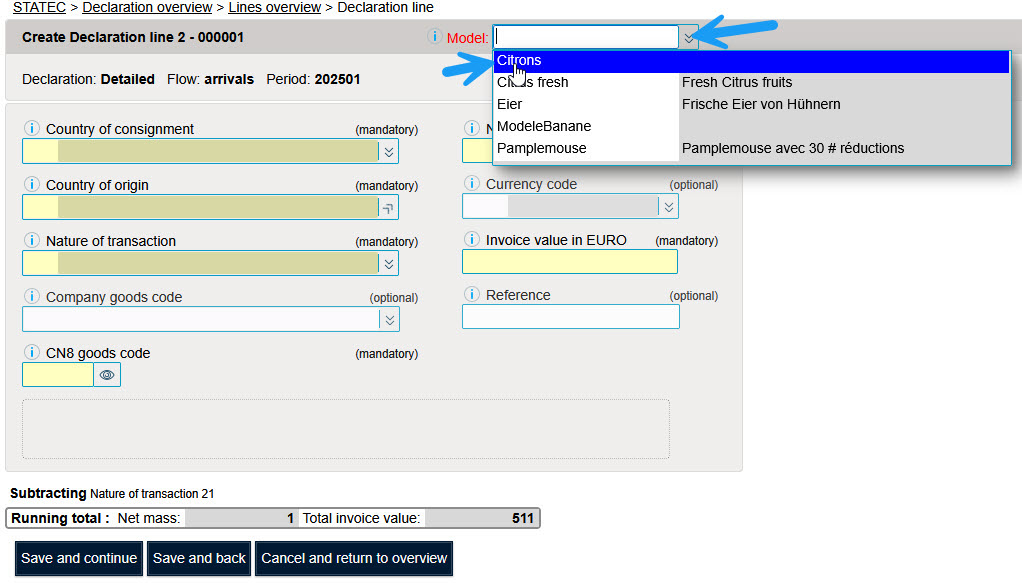

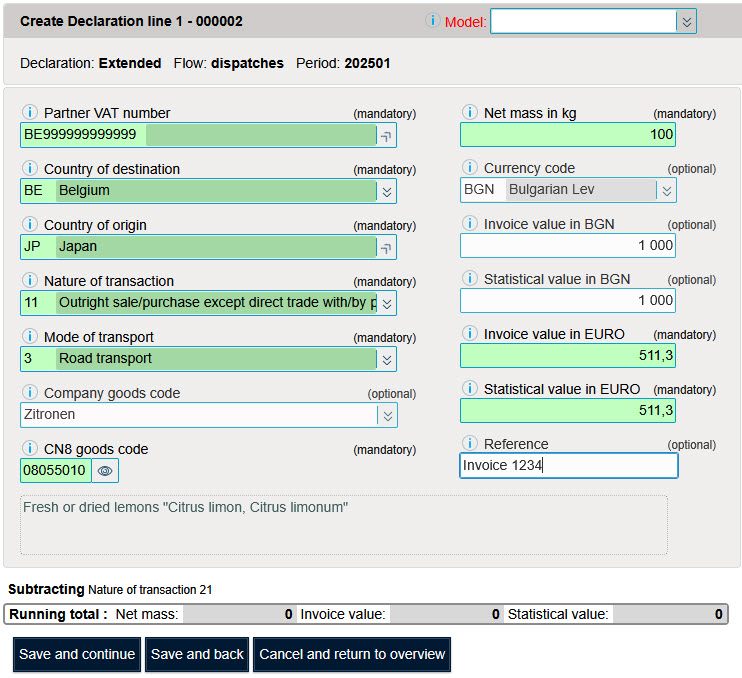

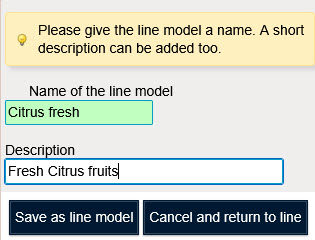

It is possible to load the template lines when encoding the declaration lines.